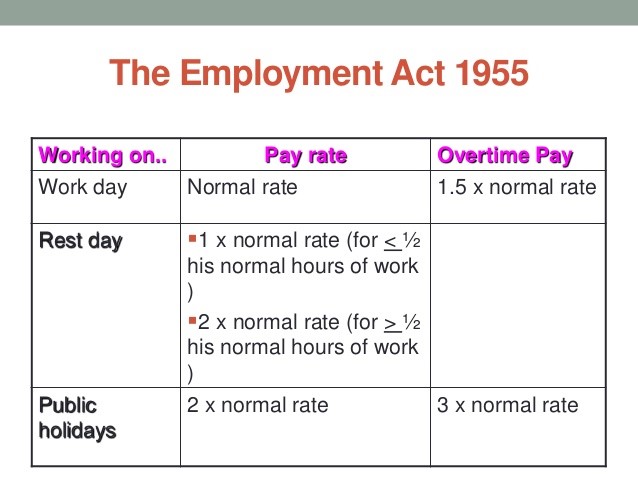

Considerations of the British. The Employment Act 1955 EA is the primary law that governs the subject of employment in Malaysia.

Formul St Partners Plt Chartered Accountants Malaysia Facebook

The Labour right if not a majority of the PLP chose a Tory victory over that possibility.

. The Code on Wages 2019. However it is to note that Malaysias labor law applies to only those whose salary does not exceed RM1500 per month. 5 7 lakhs.

The calculation is made by identifying the total number of hours the employee has actually worked over the preceding four weeks and dividing the result by four. Short title and application 1 This Act may be cited as the Employment Act 1955. In the context of employment most of these foreign workers are unaware of their rights by law which makes them easy targets for exploitation and mistreatment.

Evolution of Labour Law in India. The International Labour Organization estimated in 2019 that there were 169 million international migrants worldwide. An employee who does not work on a regular holiday is entitled to be paid 100 of salary for that day.

It provides protection for any employee specified under the. Migrant workers who work outside their home country are also called foreign workersThey may also be called expatriates or guest workers especially when they have been sent for or invited to work in the host country before leaving the home country. 7000- for calculation of bonus and it is the duty of the employer to pay minimum bonus to their employees.

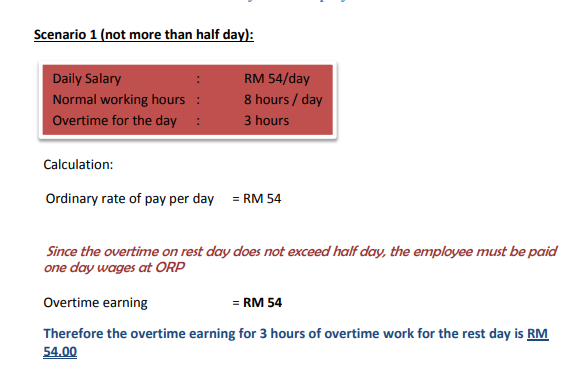

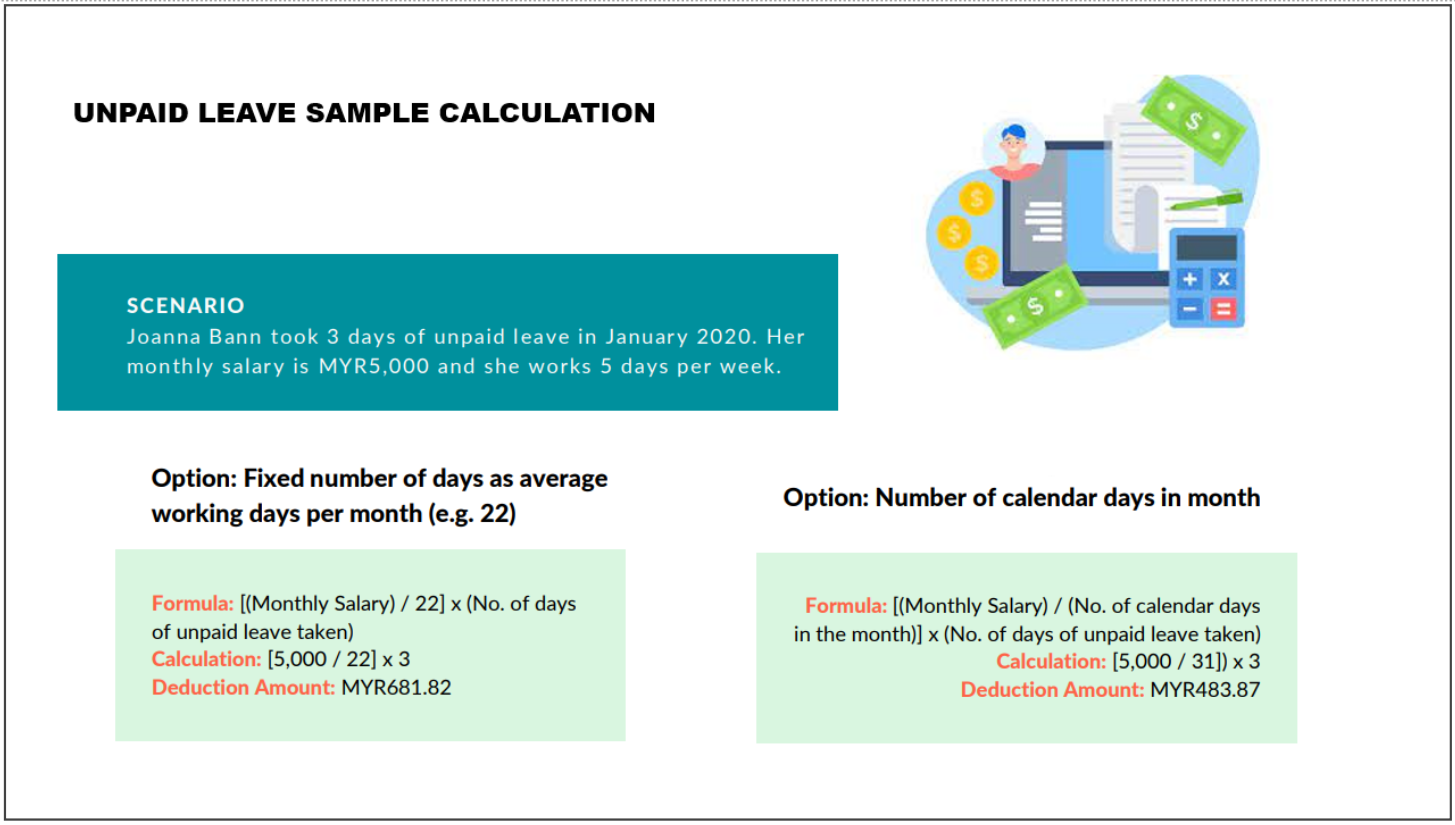

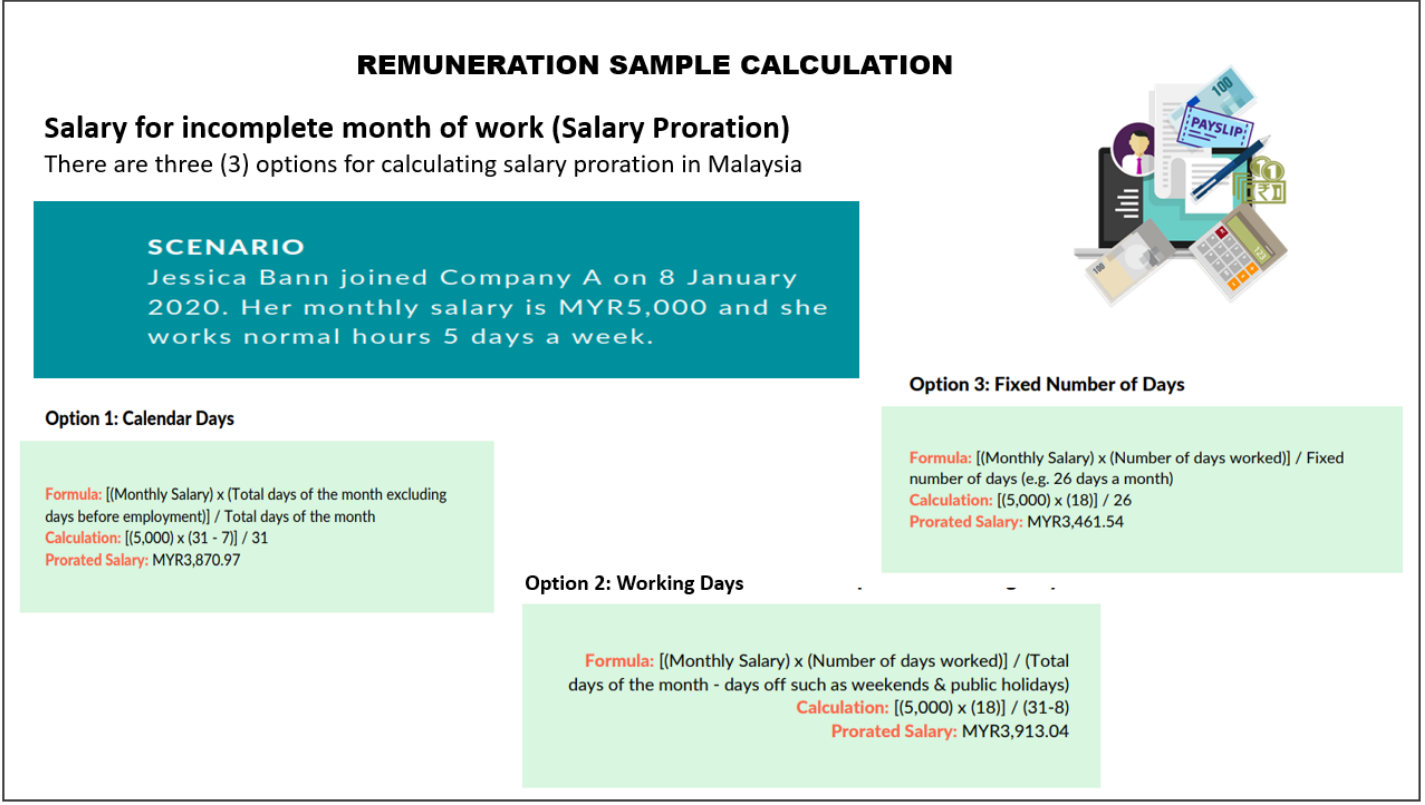

Study in Malaysia. Multiply this number by the total days of unpaid leave. The Malaysia Employment Act 1995 has been the rulebook for Malaysian companies.

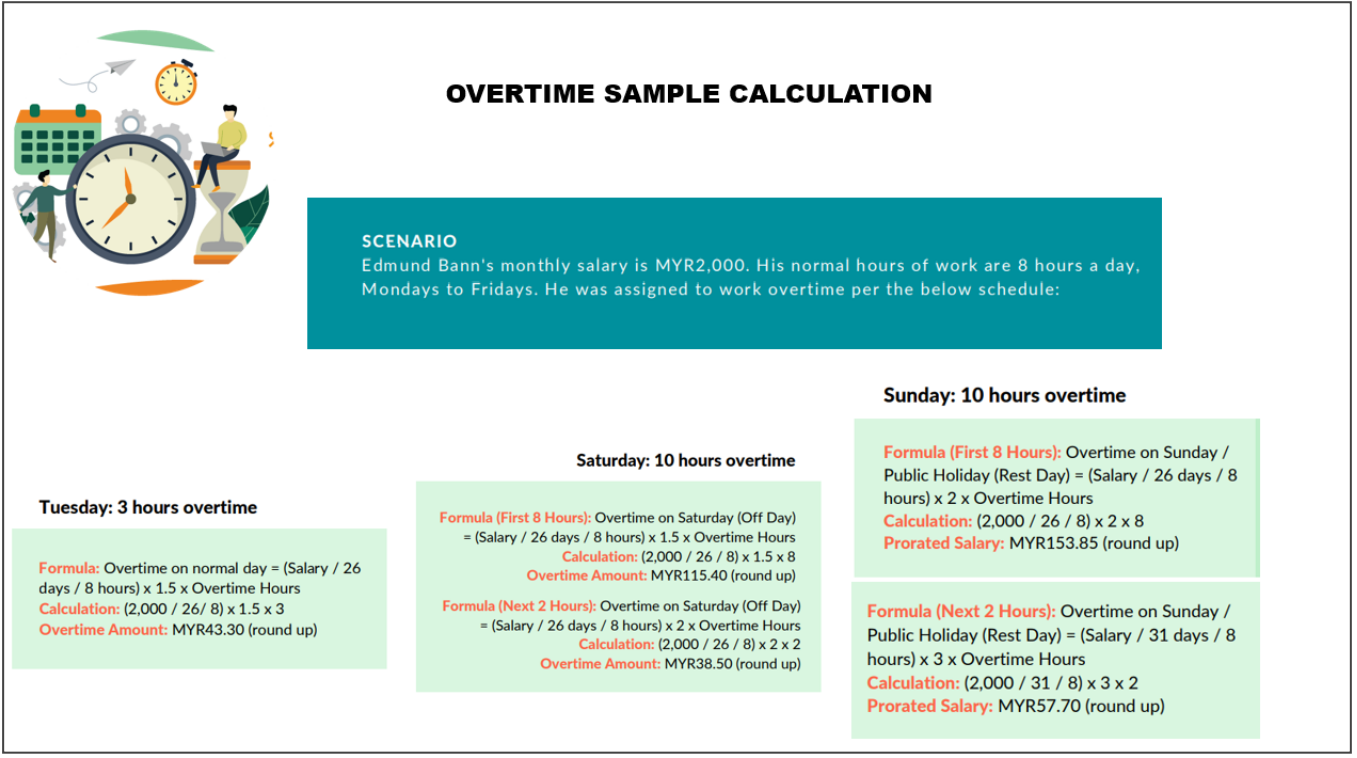

Access Google Sheets with a personal Google account or Google Workspace account for business use. Get 247 customer support help when you place a homework help service order with us. Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020.

According to the section-10 of Payment of Bonus Act 1965 it is an employee right drawing salary of Rs. The main content of the notice is as follows. 1st June 1957 PART I - PRELIMINARY.

The Occupational Safety Health and Working Conditions Code 2020. To claim for payment of minimum bonus that is 833 of his salary his her salary will be treated as maximum Rs. Effective from January 2020 resident individuals who earn more than 2 million annually will be taxed at 30.

Company Law - Many companies are receiving notices under section 248 sub-section 1 from their respective Registrar of Companies. The Employer may deduct from the service gratuity any amount that the Worker owes him. 100 for work performed on days off and holidays.

The Labour Party could not continue as the broad church it. The Code for Social Security 2020. In India the history of labour law is interwoven with the history of British colonialism.

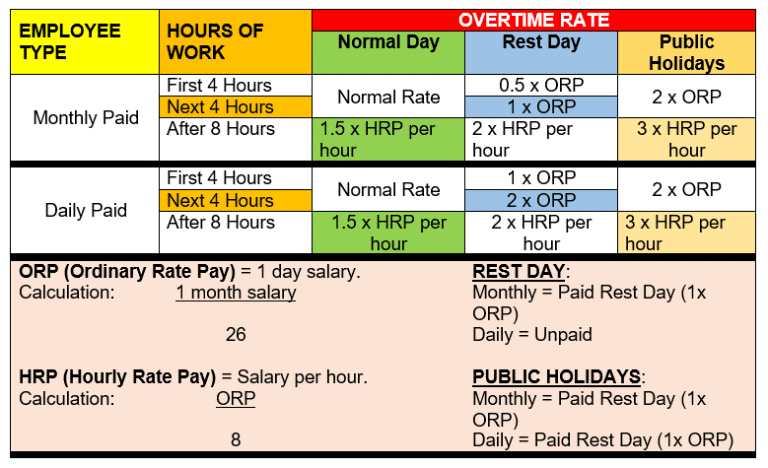

Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month. An employee who works on a regular holiday is entitled to 200 of salary for that day. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The former remains to be the foundation of Chinas employment laws while the latter allowed for the improved implementation of the labor principles contained in the 1995 Labor Law. If the employee has completed less than four weeks service the same basis for calculation can be relied on for a preceding period of one two or three weeks. An estimated 50 of Irans GDP was exempt from taxes in FY 2004.

According to Article 15 of the Law No. An employee who works more than 8 hours overtime work on a holiday shall be paid an additional 30 of the hourly rate. An Act relating to employment.

There are different specializations available for candidates to choose from like Labour Law Commercial Law Business Law Corporate Law Criminal Law Cyber Law. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. There are virtually millions of.

To amend and consolidate a majority of Indian labour laws the following four labour codes have been passed by the Parliament of India which subsumes and amalgamates 29 different central labour laws legislations. The building tax calculation method differentiates between buildings depending on their destination usage. Tax rate between 008 and 02 applicable to the taxable value as per the specific table provided by the law for individuals and the value resulted from the evaluation report for legal entities.

The minimum obligatory annual increase is set at no less than 7 of the basic salary which is the basis for calculation of social insurance. End of service gratuity according to Domestic Workers Law. The industriallabour-law enacted by the British was meant primarily to protect the British employers interests.

Find the number of working days in the current month. The labour and employment law in India is also known as Industrial law. Manual calculation of unpaid leave.

2017 revealed to the horror of the establishment and the Labour right that the left could win. The calculation of the gratuity shall be based on the Workers last Basic Wage. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees.

The minimum premiums are set at 35 of the normal pay for overtime work during daylight and 70 for work at nighttime. Malaysias Labor Law on Normal Working Hours VS Overtime. The subscribers to the memorandum have not paid the subscription which they had undertaken to pay at the time of incorporation of a company and a declaration to this effect.

15 of 2017 on Domestic Workers. As a result of the lack of efficient and effective means of implementing the 1995 China Labor Law the 2008 China Labor Contract Law was enacted.

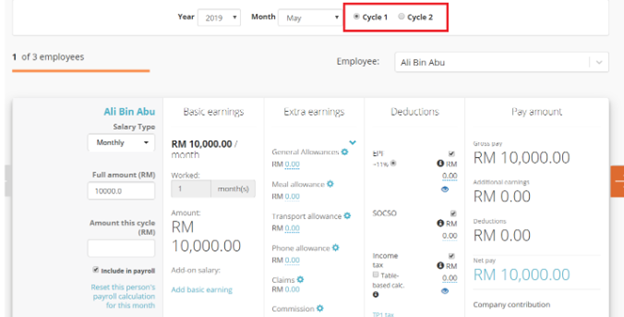

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Overtime Calculator For Payroll Malaysia Smart Touch Technology

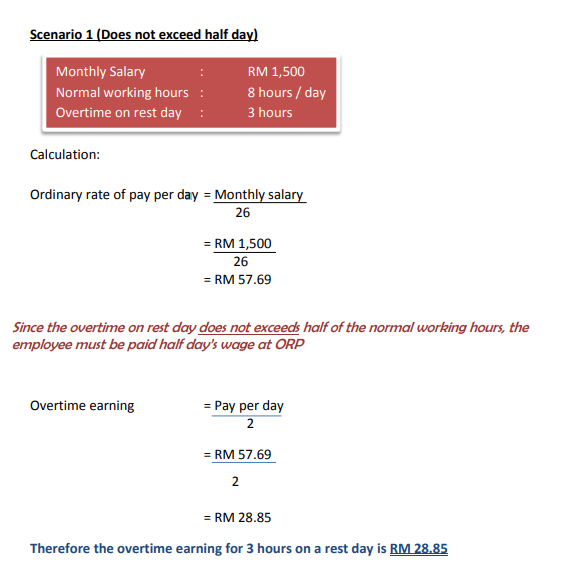

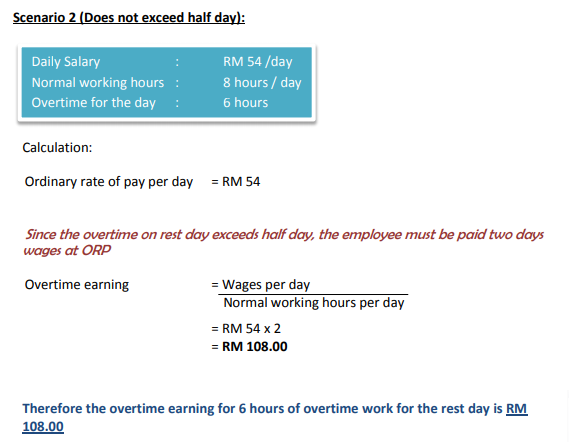

Labour Law Malaysia Salary Calculation Madalynngwf

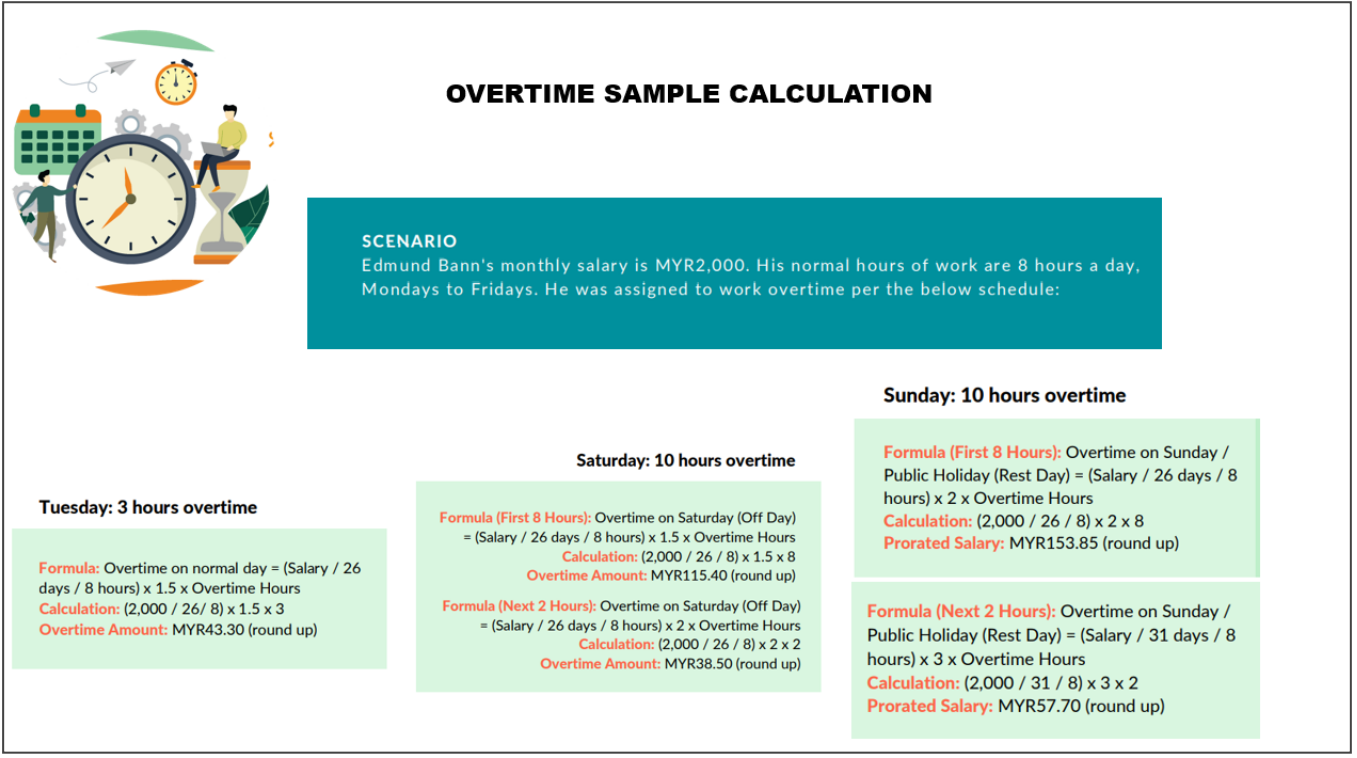

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Dna Hr Capital Sdn Bhd

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog